COVES: Six Months In

Introduction

Last summer we published an SSRN paper and blog post detailing our latest investment idea, a volatility-hedged equity strategy with a switch that would toggle between certain market positions based on a simple moving average signal. This strategy worked well inside of the US market using the S&P 500 and VIX as well as the S&P 500 and a synthetic VIX that simplified the VIX calculations without sacrificing the root concept of tracking market uncertainty. We then expanded the idea to over 40 countries, with performance once again exceeding a simple buy-and-hold of the country’s overall equity market. This led us to labeling the idea as Country-Oriented Volatility-Enhanced Strategies, or COVES.

While COVES showed a ubiquitous robustness across country equity markets (and even synthetically-created equity markets as per our Haiti example in the blog post above), the major flaw with COVES was that it is currently aggressively difficult to enact as a viable investment strategy. This is due to VIX (or the synthetic equivalents of a volatility index) being unavailable for direct investment. Volatility indexes do not have an underlying investable asset that an investor can hold a position in, leaving derivatives as the only option for a reflection of VIX in one’s portfolio. Unfortunately, current derivatives and other investable products based on these derivatives (i.e. ETNs such as VXX, UVXY, and others that are based upon a collection of VIX derivatives) deviate enough from the underlying volatility index that they are not viable for substitution into COVES (much of this is due to a behavioral finance phenomenon and will be further addressed in a future blog post). This leaves us between a rock and a hard place: COVES shows a very promising path forward for long-only, buy-and-hold investing, but cannot be implemented with the tooling and products currently available on the market.

This is where Decentralized Finance (DeFi) and the concept of synthetic tokens come into play. We’ve touched on DeFi and synth tokens again and again and again to the point that the loyalest of readers (hi Mom!) is probably sick of us bringing it up. However, the root concept of a synthetic token is so powerful and boundary-pushing in terms of financial products that it deserves to be mentioned as much as possible. The short explanation is that a synthetic token is a blockchain-based asset that tracks and returns the performance of a predefined index whose price is easily determined. For instance, the S&P 500 is an index that combines the top 500ish stocks in the US market in terms of market capitalization. Sure, investable assets makes sense for an index, but why 500? Why market cap? They’re arbitrarily chosen to act as a reflection of a certain perspective of market health and performance for the US market overall. Building an index from VIX or a synthetic volatility index is the same idea: we want to track the uncertainty of the market given a predetermined set of definitions readily available online for anyone to access. The difference is that VIX or a synthetic index doesn’t have that underlying asset (i.e. an ownership stake in a company for an equity) that the stocks in the S&P 500 do have.

That changes with a synthetic token.

A synthetic token is a new type of financial derivative that allows for a synthetic index to be built as an asset via DeFi technology, The example case we typically bring up is UMA Project and Yam Finance’s “uSTONKS” synth token, a token that tracks the 10 most-bullish stocks on r/WallStreetBets. Without getting into the technicals, uSTONKS updates its price based on public and predetermined data, namely the price of the stocks within the index during the token’s duration. Once the token expires at the end of its run, the amount returned to investors reflects the change in price from the start of the uSTONKS token period to its end. By adhering to this system and offering up a transparent, trustless architecture around this index and synth token, an index that is unavailable to invest in via traditional finance suddenly becomes a possibility via DeFi. By making a synth token of COVES (or of the synthetic volatility index used within COVES itself), we can fully realize the performance of this investment strategy without resorting to inferior derivatives of volatility that eradicate the true performance of a long-term, volatility-enhanced buy-and-hold position.

However, two major obstacles stand between COVES as an idea and COVES as an executable strategy: synth token technology catching up to the complexity needed to run a dynamic, hetero-periodic strategy like COVES, and proof positive that COVES actually works as a strategy and isn’t due to back-testing and/or over-fitting. We can’t really do much at Novatero with the former (we don’t have the time, resources, or aptitude to work on the guts of DeFi tokenization), but we can prove out COVES as a strategy via out-of-sample testing. Actual trading is out of the question (again, no way to actually hold a position in VIX/synthetic volatility), but we can paper trade COVES to show its effectiveness. What better way to do this than by putting our money where our mouths are and publicly post upcoming positions and total returns on a daily basis on Twitter? Well, we’ve been doing this since the beginning of October 2021 and now have six full months of out-of-sample data with which to show whether or not COVES actually works. The results of those six months are discussed below.

Six-Month Performance Results of COVES

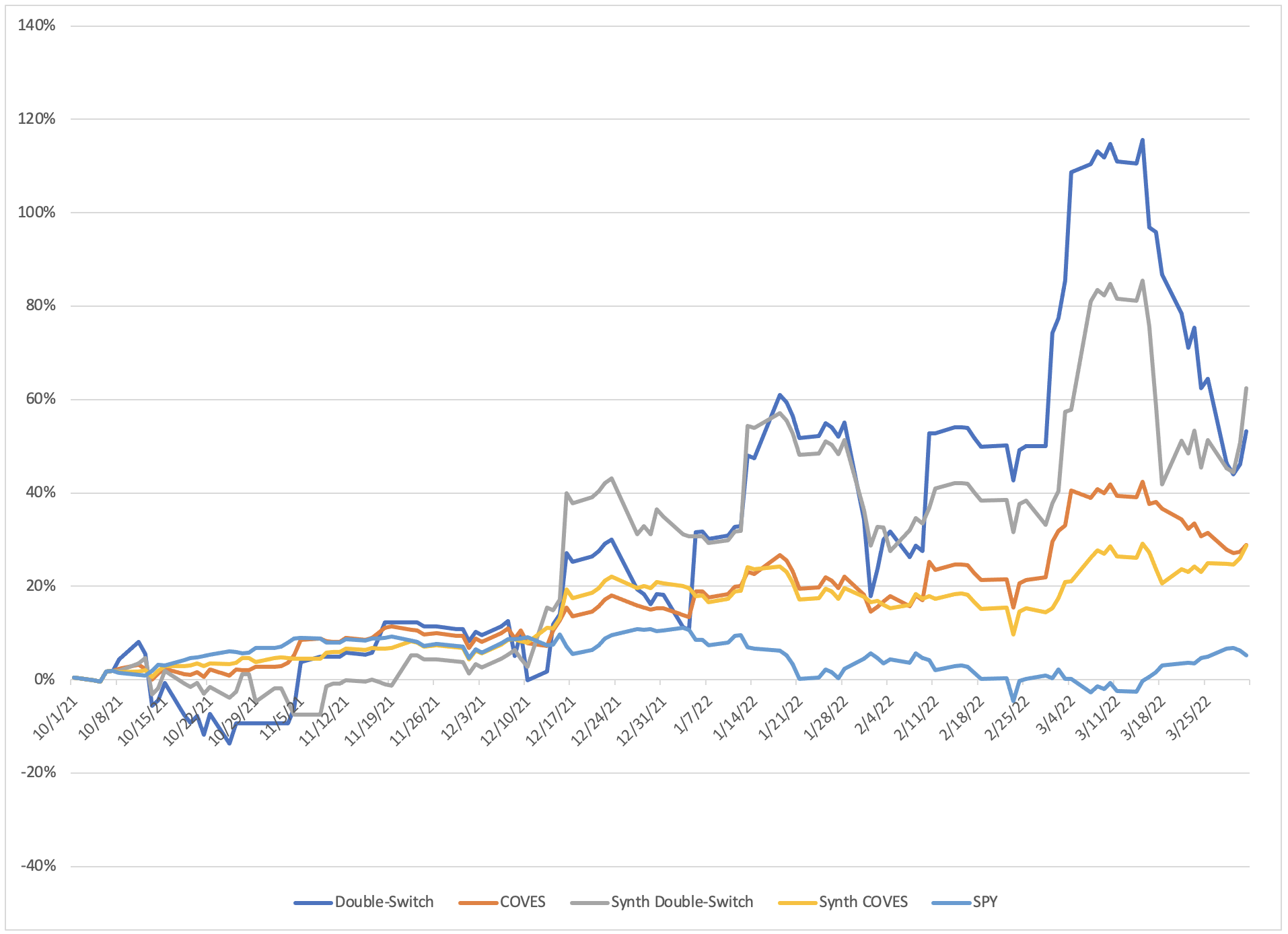

Figure 1. Total return of five labelled strategies over time from October 2021 through March 2022.

While your eyes might have automatically focused on the end results over these six months in Figure 1, we’d like to draw your eyes back over to the first month of this period. The double-switch for both the VIX-based COVES and the synthetic volatility COVES were down, leading to COVES and Synth COVES underperforming the SPY benchmark until about mid-November. After that point, the double-switches caught some very favorable winds and launched COVES/Synth COVES well above SPY. Even with the massive drawdowns in the double-switches in March (more on them later), COVES and Synth COVES still finished the six-month period well ahead on SPY, coming in serendipitously neck-and-neck.

Table 1. Six-Month Return, Standard Deviation, Skewness, and Sharpe ratio for five labelled strategies from October 2021 through March 2022. Risk-free rate for Sharpe ratio was calculated from the 10-year Treasury rate on 4/1/22.

Table 1 sums up what we can see in Figure 1. The double-switches ended up outperforming the more-balanced COVES’ in terms of return, but the road there was very dynamic. The dramatic reduction in volatility that COVES provided in our initial publication is corroborated with this first chunk of out-of-sample testing, leading to a favorable Sharpe ratio above 1 for both COVES and Synth COVES. There are two additional points of interest here that I’d like to address:

SPY is by-far the worst performer during this period, both in terms of return as well as Sharpe ratio. Part of the appeal of COVES is that it offers higher-than-index-only returns with a minimal gross increase in volatility (and thus an increase in the Sharpe ratio). There is an outside case to be made for just running the double-switch by itself if its Sharpe ratio does better than the market…but try telling a retail investor that the returns are worth the pain of your position regularly dropping double-digits at the drop of a hat.

The Synth Double-Switch is actually less-volatile than the VIX-based switch it is supposed to mimic and ended up with a Sharpe ratio that was much closer to that of the two COVES variations. Part of this is due to the lower bound that the Synth Vol index uses: Synth Vol cannot dip below 12, so any moves that would put it below that threshold are Winsorized back up to 12. This artificial lower limit could be providing some added stability to Synth COVES and might need a deeper examination going forward.

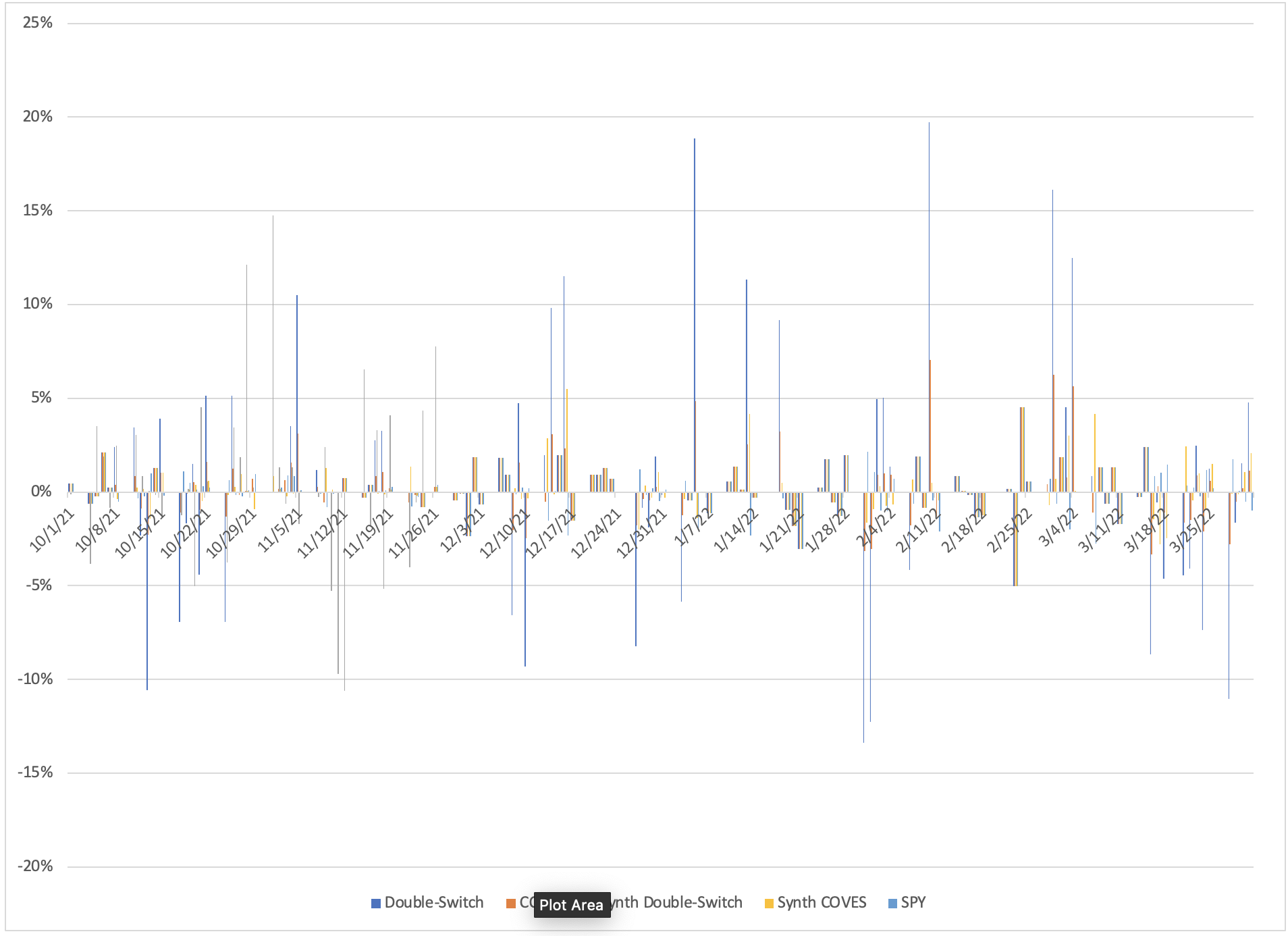

Figure 2. Daily returns for the five labelled strategies from October 2021 through March 2022.

Looking at daily returns via Figure 2 helps to understand some of this movement a bit more. The double-switches regularly see moves an order of magnitude higher than COVES or spy, leading to the significantly higher amount of flux around the switches themselves. Pairing the switches with a majority position in the underlying index (SPY) leads to a massive reduction in return spread, but is still one that favors positive return movement over time. In other words, when the double-switch is wrong it tends to be wrong while the underlying index is right, but when the double-switch is correct, it tends to either be in-agreement with the underlying index OR the lag effect of a reciprocal drop in the index leads to a favorable mix of positioning in COVES. What do we mean by this? A massive positive return in the volatility position of the double-switch doesn’t necessarily happen on the same day as a decline in the long index, meaning that a flat or even slightly negative return in the majority position in the index is more-than-covered by the massive return in the minority volatility position, while a small negative return the switch can be offset by a reasonable positive return in the market index. This leads to a small downtick in the positive:negative daily return balance for COVES relative to the switches.

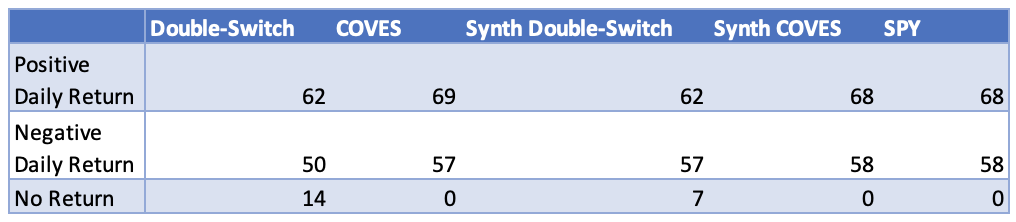

Table 2. Count of positive, negative, and no return days for the five labelled strategies from October 2021 through March 2022.

COVES and SPY are practically even in terms of +/- balance, but it’s the double-switch sitting out on certain days that really helps with loss mitigation. This is likely where much of the difference between COVES and SPY happens: going in big on potential big return days, leading to big gains (or losses) and a gradual maintenance of that total return over non-potential days.

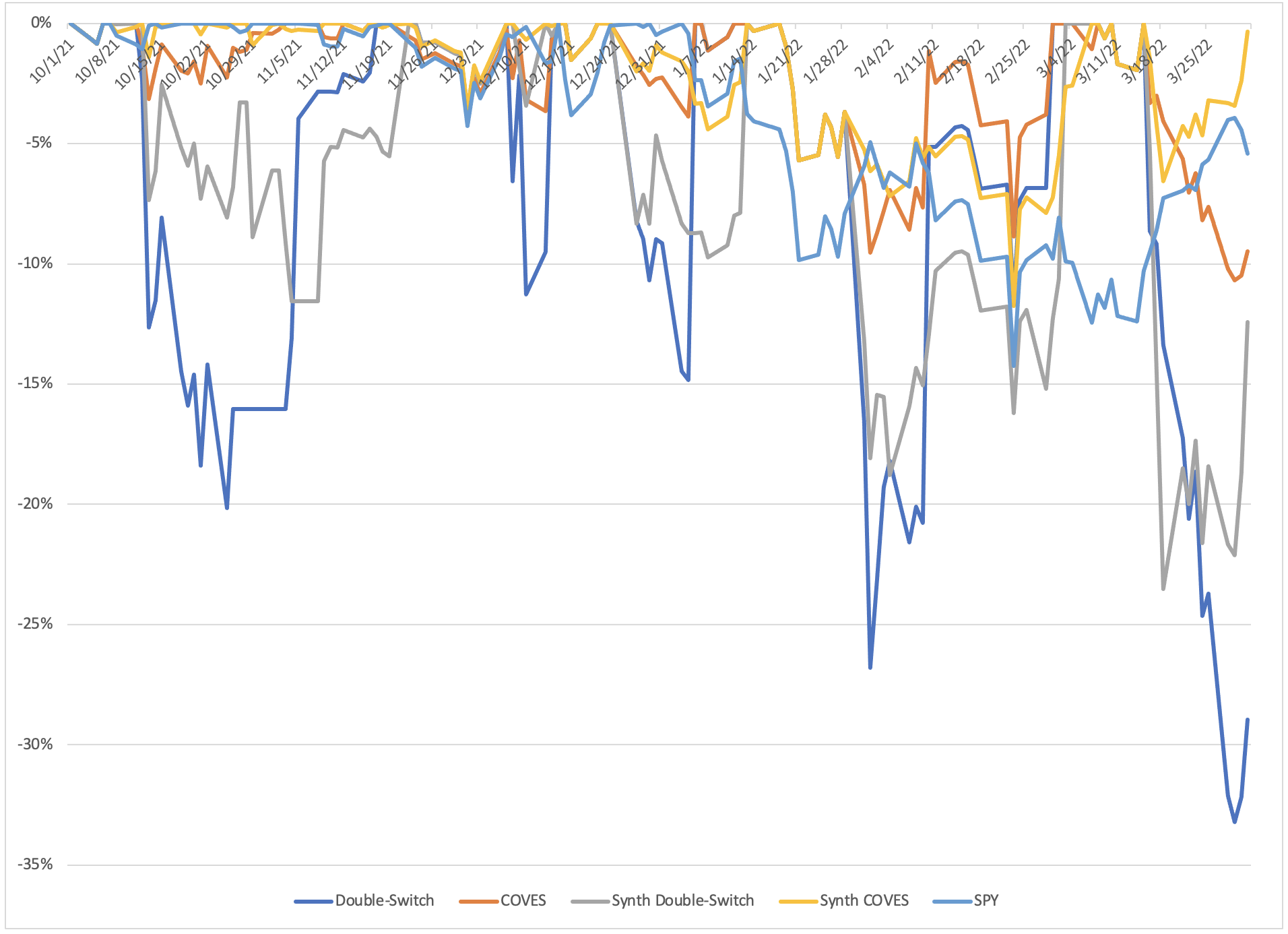

Figure 3. Drawdowns for the five labelled strategies starting in October 2021 through March 2022.

Finally, we take a look at drawdowns for each strategy. This further reinforces the mercurial ride an investor would be in for if they went in solely on the switches instead of the more-balance COVES. While the switches have a higher return over this period, they also have some massive drawdowns, culminating with a -33% nadir on March 29th. That drawdown is in the 88th percentile over the entirety of the historical data for this double-switch dating back to 2009, so while it’s a rare occurrence, it does happen from time-to-time, sometimes with an even greater dip than this one. Conversely, the max drawdown for COVES or Synth COVES never exceeded SPY over this period, providing a more-stable downside protection than the root index despite the inclusion of a highly-volatile minority position. COVES does sacrifice some return relative to the double-switch, but given its higher return, higher Sharpe ratio, and shallower max drawdown compared to SPY and its low-volatility day-to-day relative to the double-switch, a reliable high-return, low-volatility strategy presents the best of both worlds in terms of ROI and, you know, being able to sleep at night.

So, is this it for proving out COVES? While this was a very good initial out-of-sample test for the strategy, not many professionals in the industry will be wooed by a half-year track record. In fact, we’ve got to imagine that this will require at least another year of out-of-sample testing before anyone will give it a second look. On top of that, we’ll need to hope that synthetic token technology comes along fast enough to make COVES viable when investors are willing to put funds behind this strategy. There is still plenty of work to do and plenty more check-ins on out-of-sample testing, but this is a good first step upon which to build on. See you in six months!